Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Abbott Laboratories | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Abbott Laboratories

100 Abbott Park Road

Abbott Park, Illinois 60064-6400 U.S.A.

On the Cover:Sadie Rutenberg

Tyrone Morris

Seattle, WashingtonMilwaukee, Wisconsin

As a participant in a clinical trial, Sadiewas the first child in the United States toreceive Abbott's Masters HP 15mm, theworld's smallest rotatable mechanicalheart valve. Approved by the U.S Foodand Drug Administration in 2018, thisdime-sized device can be a life-savingoption for critically ill children. Today,SadieTyrone Morris is a happy, active toddler, who lovesvery busy man. With

a restaurant to tell new friends aboutrun and a weekly bowling

league to dominate, he doesn't let

anything slow him down—not even heart

failure. Abbott technologies have let him

get back to leading the "sparkle" inlife he wants toher heart.live.

| | PAGE | |

|---|---|---|

| | | |

Notice of Annual Meeting of Shareholders | 2 | |

Proxy Summary | 3 | |

Information About the Annual Meeting | ||

Who Can Vote | ||

Notice and Access | ||

Cumulative Voting | ||

Voting by Proxy | ||

Revoking a Proxy | ||

Discretionary Voting Authority | ||

Quorum and Vote Required to Approve Each Item on the Proxy | ||

Effect of Withhold Votes, Broker Non-Votes, and Abstentions | ||

Inspectors of Election | ||

Cost of Soliciting Proxies | ||

Abbott Laboratories Stock Retirement Plan | ||

Confidential Voting | ||

Householding of Proxy Materials | ||

Nominees for Election as Directors (Item 1 on Proxy Card) | ||

The Board of Directors and its Committees | ||

The Board of Directors | ||

Leadership Structure | ||

Director Selection | ||

Board Diversity and Composition | ||

Board Evaluation Process | ||

Committees of the Board of Directors | ||

Communicating with the Board of Directors | ||

Corporate Governance Materials | ||

| ||

Security Ownership of Executive Officers and Directors | ||

Executive Compensation | ||

Compensation Discussion and Analysis | ||

Compensation Committee Report | ||

Compensation Risk Assessment | ||

Summary Compensation Table | ||

| ||

| ||

| ||

Pension Benefits | ||

Potential Payments Upon Termination or Change in Control | ||

CEO Pay Ratio |

| | PAGE | |

|---|---|---|

| | | |

Ratification of Ernst & Young LLP as Auditors (Item 2 on Proxy Card) | ||

Report of the Audit Committee | ||

Say on Pay—An Advisory Vote on the Approval of Executive Compensation (Item 3 on Proxy Card) | ||

Shareholder | ||

Shareholder Proposal on | ||

Proponent's Statement in Support of Shareholder Proposal | ||

Board of Directors' Statement in Opposition to the Shareholder Proposal | ||

Shareholder Proposal on Non-GAAP Financial Performance Metrics Disclosure (Item 5 on Proxy Card) | 74 | |

Proponent's Statement in Support of Shareholder Proposal | 74 | |

Board of Directors' Statement in Opposition to the Shareholder Proposal | 75 | |

Shareholder Proposal on Shareholder Voting on By-law Amendments (Item 6 on Proxy Card) | 76 | |

Proponent's Statement in Support of Shareholder Proposal | 76 | |

Board of Directors' Statement in Opposition to the Shareholder Proposal | 77 | |

Shareholder Proposal on Simple Majority Vote (Item 7 on Proxy Card) | 78 | |

Proponent's Statement in Support of Shareholder Proposal | 78 | |

Board of Directors' Statement in Opposition to the Shareholder Proposal | 79 | |

Approval Process for Related Person Transactions | ||

Additional Information | ||

Information Concerning Security Ownership | ||

| ||

Date for Receipt of Shareholder Proposals for the | ||

Procedure for Recommendation and Nomination of Directors and Transaction of Business at Annual Meeting | ||

General | ||

Exhibit A—Director Independence Standard | A-1 | |

Reservation Form for Annual Meeting | Back Cover |

Abbott Laboratories ![]() 1

1

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

YOUR VOTE IS IMPORTANT

Please sign and promptly return your proxy

in the enclosed envelope, or vote your

shares by telephone or using the Internet.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on April 26, 201924, 2020

The Annual Meeting of the Shareholders of Abbott Laboratories will be held at Abbott's headquarters, 100 Abbott Park Road, at the intersection of Route 137 and Waukegan Road, Lake County, Illinois, on Friday, April 26, 2019,24, 2020, at 9:00 a.m. for the following purposes:

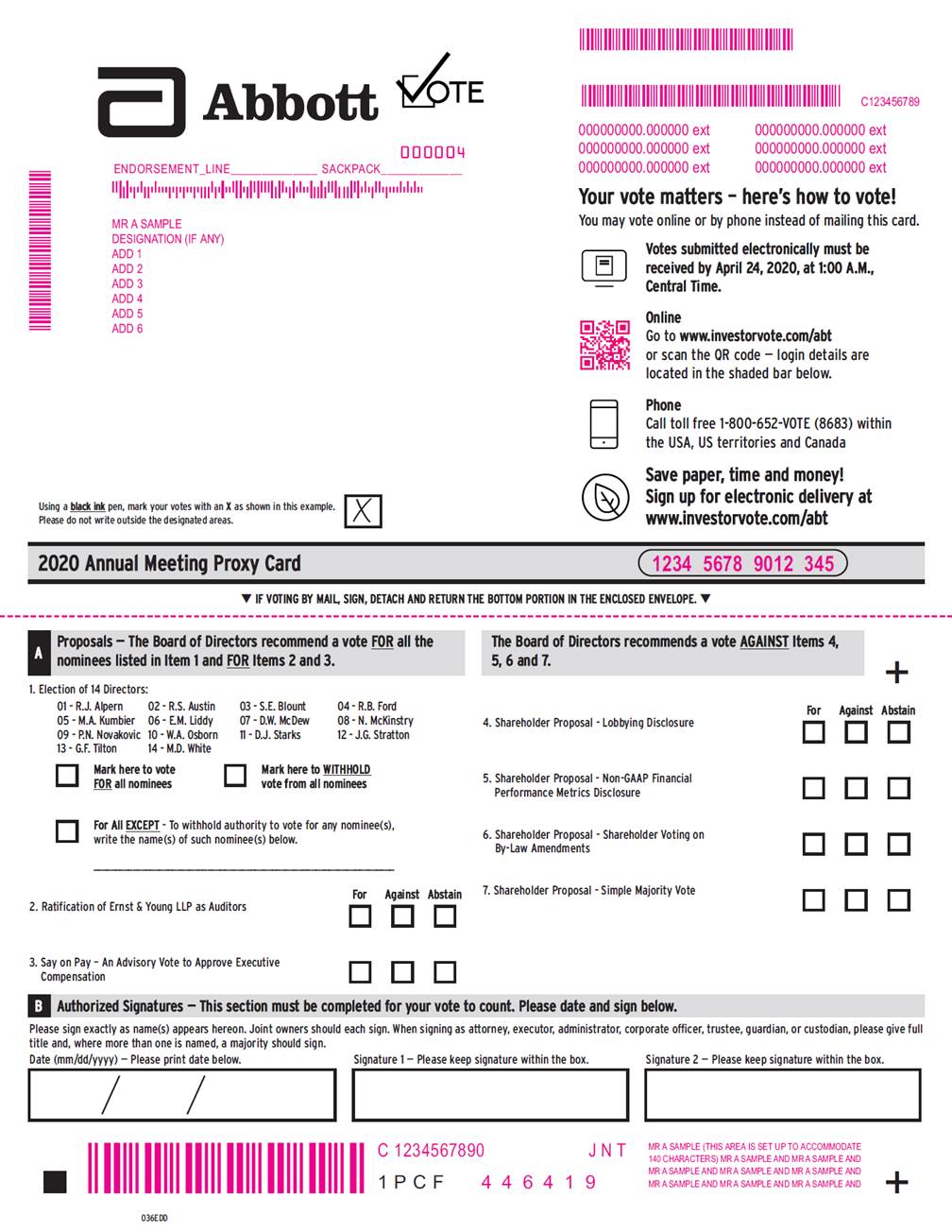

The Board of Directors recommends that you vote FOR Items 1, 2, and 3.

The Board of Directors recommends that you vote AGAINST Item 4.Items 4, 5, 6, and 7.

The close of business on February 27, 2019,26, 2020, has been fixed as the record date for determining the shareholders entitled to receive notice of and to vote at the Annual Meeting.

Abbott's 20192020 Proxy Statement and 20182019 Annual Report to Shareholders are available at www.abbott.com/proxy.

If you are a registered shareholder, you may access your proxy card by either:

Admission to the meeting will be by admission card only. If you plan to attend, please complete and return the reservation form on the back cover, and an admission card will be sent to you. Due to space limitations, reservation forms must be received before April 19, 2019.17, 2020. Each admission card, along with photo identification, admits one person. A shareholder may request two admission cards, but a guest must be accompanied by a shareholder.

By order of the Board of Directors.

Hubert L. Allen

Secretary

March 15, 201913, 2020

2 Abbott Laboratories![]()

This summary contains highlights about Abbott and the upcoming 20192020 Annual Meeting of Shareholders. This summary does not contain all of the information that you should consider in advance of the meeting, and we encourage you to read the entire proxy statement carefully before voting.

The accompanying proxy is solicited on behalf ofby the Board of Directors on behalf of Abbott for use at the Annual Meeting of Shareholders. The meeting will be held on April 26, 2019,24, 2020, at Abbott's headquarters, 100 Abbott Park Road, at the intersection of Route 137 and Waukegan Road, Lake County, Illinois. This proxy statement and the accompanying proxy card are being mailed to shareholders on or about March 15, 2019.13, 2020.

|

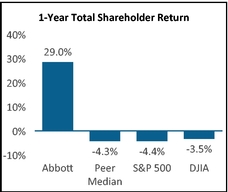

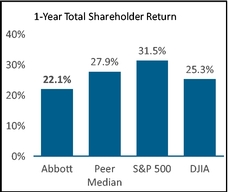

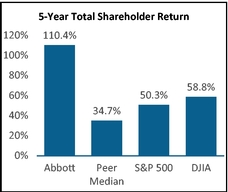

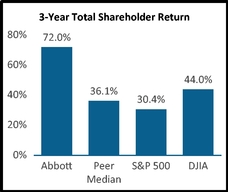

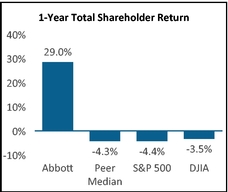

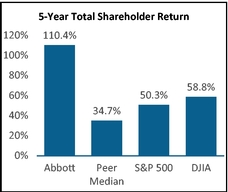

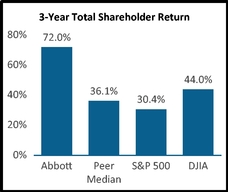

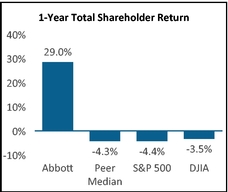

Abbott achieved outstanding returns for shareholders in 2018 and for the second consecutive year ranked #1 in our peer group.Abbott's one-yearthree-year total shareholder return (TSR) was 29.0%, delivering significant shareholder returns despite negative returns of –3.5% and –4.4% for both the Dow Jones Industrial Average (DJIA) and Standard & Poor's 500 Index (S&P 500), respectively.

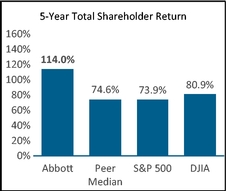

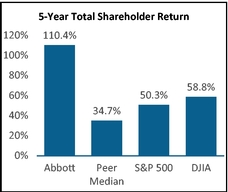

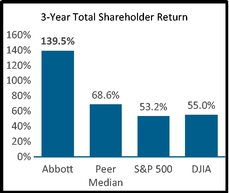

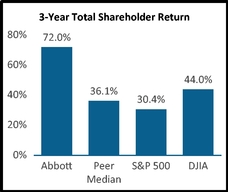

During a period of strategic shaping including the additions of St. Jude Medical and Alere Inc., which positioned Abbott as a leader in several new areas of cardiovascular care, neuromodulation and rapid diagnostic testing,Abbott's three- and five-year TSR of 72.0% and 110.4%, respectively, are139.5% is more than twice that of the peer group median and the broader SStandard & Poor's 500 (S&P 500500) and Dow Jones Industrial Average (DJIA) market indexindices. These consistent above-market returns are driven by the strength of our positionleadership positions in many high-growthsome of the largest and fastest growing markets in healthcare markets and our robust organic pipeline of innovative productsproduct portfolios across all of our businesses.

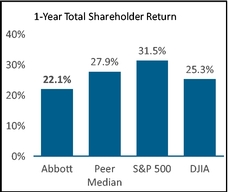

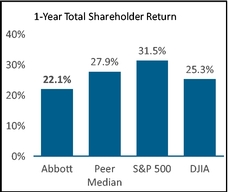

Abbott delivered strong returns for shareholders in 2019 and achieved or exceeded the financial targets set at the beginning of last year. Abbott's one-year TSR was 22.1%, delivering significant shareholder returns on top of the one-year TSR of 29% in 2018, which ranked #1 in our peer group.

| ||||

|  |   |

In addition to delivering significant shareholder returns, Abbott continued to make significant progress in positioningtake important steps to position the Company for long-term, and sustainable growth.

Abbott Laboratories ![]() 3

3

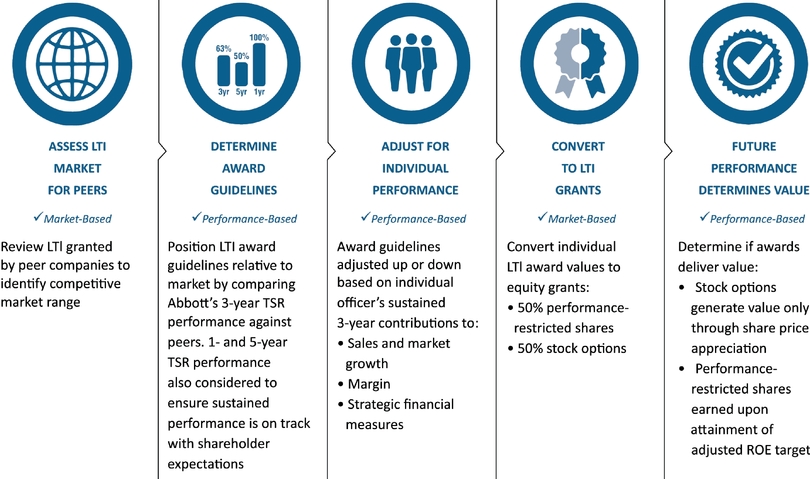

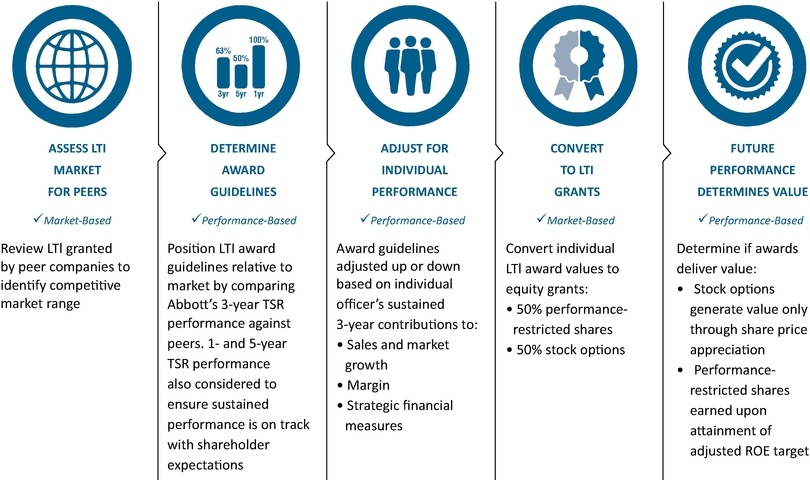

EXECUTIVE COMPENSATION |

During 2018,2019, we conducted extensive shareholder outreach to discuss our compensation program.program, among other topics. In the spring, we engaged shareholders representing approximately 60%over 65% of our outstanding shares in an open dialogue to discuss various topics, including the enhanced disclosures in our executive compensation program. Many of these discussions included our Lead Independent Director and the Chair of our Compensation Committee, giving shareholders the opportunity to provide important feedback directly to members of our Board. The feedback we received indicated2019 proxy that overall, shareholders viewed our executive compensation program favorably, and that additional enhancements to our proxy disclosure could furtherfurthered shareholder understanding of how pay decisions are made and how the metrics we use are linked to business strategy and goals. Their feedback was overwhelmingly positive, which was reflected in the 94% support for Say-on-Pay Vote.

In the fall, we continued our dialogue with shareholders. Our Lead Independent Directorshareholders and shared the Chairprocess we used to review and update our peer group in 2019 to better reflect Abbott's size and complexity. Shareholders were highly supportive of our approach and agreed with the changes approved by the Compensation Committee again facilitated many of these discussions, where we sharedCommittee. Additional information regarding the enhancements we intendedchanges to make to our proxy disclosure following the shareholder input we received in the spring. Shareholder responses were overwhelmingly positive, and the enhanced disclosureAbbott's peer group can be found on pages 34 to 43page 32 of this proxy statement.

KEY FEATURES OF OUR EXECUTIVE COMPENSATION PROGRAM

The following practices and policies ensure alignment of interests between shareholders and executives, and effective ongoing compensation governance.

| COMPENSATION PRACTICE | | ABBOTT POLICY | | MORE INFORMATION ON PAGE | | |||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| | Compensation is Market-Based | | Yes | | Benchmark peers with investment profiles, operating characteristics, and employment and business markets similar to Abbott. Annual incentive plan goals are set to exceed market growth in relevant markets/business segments | | | |||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| Compensation is Performance-Based | Yes | Short-term and long-term incentive awards are 100% performance based. Annual incentive plan goals are set to exceed market growth in relevant markets/business segments | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| | Double-Trigger Change in Control | | Yes | | Provide change in control benefits under double-trigger circumstances only | | | |||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| Recoupment Policy | Yes | Forfeiture for misconduct provision in equity grants and recoup compensation when warranted | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| | Robust Share Ownership Guidelines | | Yes | | Require significant share ownership for officers and directors, and share retention requirements until guidelines are met | | | |||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| Capped Incentive Awards | Yes | Incentive award payments are capped | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| | | | | | ||||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| No | No | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| | | No | | No | | | ||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| No | No | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| | Excessive Risk Taking | | No | | No highly leveraged incentive plans that encourage excessive risk taking | | | |||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| Hedging of Company Shares | No | No hedging of Abbott shares is allowed | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | ||||

| | Discounted Stock Options | | No | | No discounted stock options are allowed or granted | | | |||||||||||||

| | | | | | | | | | | | | | | | | | ||||

Details of the compensation decisions made for our named executive officers are outlined on pages 3438 to 43.47.

4 Abbott Laboratories![]()

DIRECTOR NOMINEES |

The Board of Directors recommends a voteFOR the election of each of the following nominees for director. All nominees are currently serving as directors. Additional information about each director's background and experience can be found beginning on page 12.13.

| Name | Principal Occupation | | Age | Director Since | Committee Memberships | | Name | Principal Occupation | | Age | Director Since | Committee Memberships | | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | ||||

| | Robert J. Alpern, M.D. | Professor and Dean, | | 68 | 2008 | • Nominations & | | Robert J. Alpern, M.D. | Professor and Former Dean, | | 69 | 2008 | • Nominations and | | ||||||||||||

| | Yale School of Medicine | | | | Governance | | Yale School of Medicine | | | | Governance | | ||||||||||||||

| | | | | | • Public Policy | | | | | | | • Public Policy | | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Roxanne S. Austin | President and CEO, | 58 | 2000 | • Audit | Roxanne S. Austin | President and CEO, | 59 | 2000 | • Audit | |||||||||||||||||

| Austin Investment Advisors | • Compensation (Chair) | Austin Investment Advisors | • Compensation (Chair) | |||||||||||||||||||||||

• Executive | • Executive | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | Sally E. Blount, Ph.D. | Professor and Former Dean, | | 57 | 2011 | • Nominations & | | Sally E. Blount, Ph.D. | Professor and Former Dean, | | 58 | 2011 | • Nominations and | | ||||||||||||

| | | J.L. Kellogg Graduate School | | | | Governance | | J.L. Kellogg Graduate School | | | | Governance | | |||||||||||||

| | | of Management | | | | • Public Policy | | | of Management | | | | • Public Policy | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Robert B. Ford | President and COO, Abbott Laboratories | 46 | 2019 | • Executive | ||||||||||||||||||||||

| | | | | | | | | | | | | | ||||||||||||||

| | Michelle A. Kumbier | Chief Operating Officer, | | 52 | 2018 | • Audit | | |||||||||||||||||||

| | | Harley-Davidson Motor Company | | | | • Compensation | | |||||||||||||||||||

| | | | | | | | | | | | | |||||||||||||||

| Edward M. Liddy | Retired Chairman and CEO, | 74 | 2010 | • Audit (Chair) | ||||||||||||||||||||||

| Michelle A. Kumbier | Chief Operating Officer, | 51 | 2018 | • Audit | The Allstate Corporation | • Compensation | ||||||||||||||||||||

| Harley-Davidson Motor Company | • Executive | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | ||||

| | Edward M. Liddy | Retired Chairman and CEO, | | 73 | 2010 | • Audit (Chair) | | Darren W. McDew | Retired General, U.S. Air Force, and | | 59 | 2019 | • Nominations and | | ||||||||||||

| | The Allstate Corporation | | | | • Compensation | | | Former Commander of U.S. | | | | Governance | | |||||||||||||

| | | | | | • Executive | | | Transportation Command | | | | • Public Policy | | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Nancy McKinstry | CEO and Chairman, | 60 | 2011 | • Audit | Nancy McKinstry | CEO and Chairman of the | 61 | 2011 | • Audit | |||||||||||||||||

| Wolters Kluwer N.V. | • Nominations & | Executive Board, | • Nominations and | |||||||||||||||||||||||

| Governance | Wolters Kluwer N.V. | Governance | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | Phebe N. Novakovic | Chairman and CEO, | | 61 | 2010 | • Compensation | | Phebe N. Novakovic | Chairman and CEO, | | 62 | 2010 | • Compensation | | ||||||||||||

| | General Dynamics Corporation | | | | • Public Policy (Chair) | | | General Dynamics Corporation | | | | • Public Policy (Chair) | | |||||||||||||

| | | | | | • Executive | | | | | | | • Executive | | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

| William A. Osborn | Retired Chairman and CEO, | 71 | 2008 | • Compensation | William A. Osborn | Retired Chairman and CEO, | 72 | 2008 | • Compensation | |||||||||||||||||

| (Lead Independent Director) | Northern Trust Corporation | • Nominations & | (Lead Independent Director) | Northern Trust Corporation | • Nominations and Governance (Chair) | |||||||||||||||||||||

| Governance (Chair) | • Executive | |||||||||||||||||||||||||

| | | | | | | | | | | | | | ||||||||||||||

| | Daniel J. Starks | Retired Chairman, President and CEO, | | 65 | 2017 | • Public Policy | | |||||||||||||||||||

| | | St. Jude Medical, Inc. | | | | | | |||||||||||||||||||

| | | | | | | | | | | | | | | |||||||||||||

| John G. Stratton | Retired Executive Vice President and | 59 | 2017 | • Nominations and | ||||||||||||||||||||||

| President of Global Operations, | Governance | |||||||||||||||||||||||||

• Executive | Verizon Communications Inc. | • Public Policy | ||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | ||

| | Samuel C. Scott III | Retired Chairman, President and CEO, | | 74 | 2007 | • Audit | | Glenn F. Tilton | Retired Chairman, President and CEO, | | 71 | 2007 | • Audit | | ||||||||||||

| | Corn Products International, Inc. | | | | • Compensation | | | UAL Corporation | | | | • Public Policy | | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |||

| Daniel J. Starks | Retired Chairman, President and CEO, | 64 | 2017 | • Public Policy | Miles D. White | Chairman and CEO, | 65 | 1998 | • Executive (Chair) | |||||||||||||||||

| St. Jude Medical, Inc. | Abbott Laboratories | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |||

| | John G. Stratton | Retired Executive Vice President and | | 58 | 2017 | • Nominations & | | |||||||||||||||||||

| | President of Global Operations, | | | | Governance | | ||||||||||||||||||||

| | Verizon Communications, Inc. | | | | • Public Policy | | ||||||||||||||||||||

| | | | | | | | | | | | | | ||||||||||||||

| Glenn F. Tilton | Retired Chairman, President and CEO, | 70 | 2007 | • Audit | ||||||||||||||||||||||

| UAL Corporation | • Public Policy | |||||||||||||||||||||||||

| | | | | | | | | | | | | |||||||||||||||

| | Miles D. White | Chairman and CEO, | | 64 | 1998 | • Executive (Chair) | | |||||||||||||||||||

| | Abbott Laboratories | | | | | | ||||||||||||||||||||

| | | | | | | | | | | | | |||||||||||||||

Abbott Laboratories ![]() 5

5

CORPORATE GOVERNANCE |

Abbott is committed to strong corporate governance that is aligned with shareholder interests. TheOur Board spends significant time with the Company's senior management to understand the dynamics, issues, and opportunities in its environment and tofor Abbott. During these interactions, directors provide both insights and ask probing questions thatwhich guide management decision-making. This collaborative approach to risk oversight and emphasis on long term sustainability begins with our leaders and is engrained in the culture of our Company. The Board also regularly monitors leading practices in governance and adopts measures that it determines are in the best interest of Abbott and its shareholders.

Governance Highlights:CEO SUCCESSION PLANNING:

In November 2019, Abbott announced that Miles D. White will be stepping down as Chief Executive Officer on March 31, 2020, after a remarkable 21-year tenure. The Board of Directors appointed since 2017

With this transition, Mr. Ford will become the 13th CEO of Abbott in its 131-year history, all having been appointed from within, a testament to Abbott's strong management philosophy and Nominations & Governancesuccession-planning discipline.

Lead Independent Director with |

✓ | Elected annually by | |||||

✓ | Authority to call meetings of independent directors | |||||

✓ | Liaises between chairman and independent directors | ✓ | Reviews matters such as meeting topics and schedules | |||

✓ | Consults and engages directly with major shareholders | ✓ | Presides over executive sessions of independent directors at each regularly scheduled Board meeting |

Robust Board Evaluation and Refreshment Process |

Other Board Governance Highlights |

6 Abbott Laboratories![]()

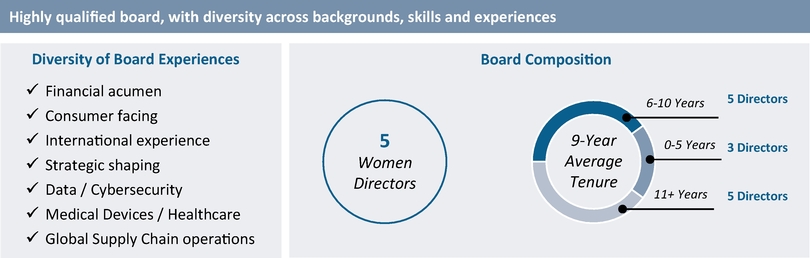

Highly qualified Board, with broad diversity across backgrounds, skills and experiences |

Active shareholder engagement throughout the year is essential to maintaining good corporate governance. We routinely seek investor input on a variety of topics, including corporate governance, executive compensation, sustainability and other strategic matters. During 2019, we conducted outreach with a cross-section of shareholders representing more than 65% of our outstanding shares. Investor sentiment and specific feedback was summarized and shared with executive management and the Board of Directors as appropriate.

![]() 7

7

SUSTAINABILITY |

At Abbott, we believe that being a responsible and sustainable business is an essential foundation for helping people live fuller, healthier lives. Abbott works hardOur Sustainability efforts are focused on the most relevant industry and company-specific risks and opportunities. The key areas of focus listed below are the basis of our Sustainability strategy. These areas have been identified through an in-depth materiality analysis, directed by executive management, and in partnership with several, diverse stakeholders. We aim to maximize the impact of the businessdeliver sustainable, responsible growth that improves lives and creates value in creating stronger communities around the world—focusing on doing the right things, for the long term.

Corporate Responsibility and Stewardship—Committed to managing our environmental impact, helping people live fuller, healthier lives by providing access to products and technologies according to the highest standards of ethical business practices.

world.

| Innovation, Access | ||||

|  |  | ||

Enterprise Risk Management—Robust risk oversight process, with a culture of focus on assessing and managing the most critical issues to our business.

|  | |

Competitive Advantage—Delivering innovative products to our patients—helping people live fuller, healthier lives. We take seriously our responsibility to provide products of the highest quality standards to patients, and it all begins with our people and talent.

| Talent | Product Quality | |||

| ||||

Robust | Award winning development programs, integrated talent management and succession planning processes |

Abbott Laboratories 7

| Climate & Water Use | Supply Chain, Packaging & Waste | Data & Data Privacy | ||

|  |  | ||

Active management of our environmental impact throughout our value chain | Committed to maintaining a high-quality, sustainable and resilient supply chain | Utilizing data to create healthcare solutions while ensuring responsible data protection |

To learn more about Abbott's sustainability efforts, please visit www.abbott.com/responsibility/sustainability.

SELECT RECOGNITION BY THIRD-PARTY ORGANIZATIONS |

| • Fortune's Most Admired Companies list in the Medical Products and Equipment sector for the past • Dow Jones Sustainability Index Industry Group Leader for | |

| • Recognized by Working Mother, Great Place to Work, DiversityInc, Science and many other publications for workplace leadership and diversity. •

| |

8 ![]()

VOTING MATTERS AND BOARD |

| Election of • Highly qualified Board, with diversity in backgrounds, skills and experiences. • Relevant expertise to provide oversight and guidance for Abbott's diversified operating model. See pages | |

| Ratification of Ernst & Young as Auditors: The Board recommends a voteFOR • Independent firm with significant industry and financial reporting expertise. • See pages | |

| Say on Pay: Advisory Vote on the Approval of Executive Compensation: The Board recommends a voteFOR •

• Aligned to drive Abbott's strategic priorities, reflects consistent above-market TSR including #1 Relative | |

|

• Proposal 4: • Proposal 5: Non-GAAP Financial Performance Metrics Disclosure • Proposal 6: Shareholder Voting on By-law Amendments • Proposal 7: Simple Majority Vote • See pages |

8 Abbott Laboratories![]() 9

9

INFORMATION ABOUT THE ANNUAL MEETING

Shareholders of record at the close of business on February 27, 201926, 2020 will be entitled to notice of and to vote at the Annual Meeting. As of January 31, 2019,2020, Abbott had 1,756,470,2691,763,433,243 outstanding common shares, which are Abbott's only outstanding voting securities. All shareholders have cumulative voting rights in the election of directors and one vote per share on all other matters.

In accordance with the Securities and Exchange Commission's "Notice and Access" rules, Abbott mailed a Notice of Internet Availability of Proxy Materials (the "Notice") to certain shareholders in mid-March of 2019.2020. The Notice describes the matters to be considered at the Annual Meeting and how the shareholders can access the proxy materials online. It also provides instructions on how those shareholders can vote their shares. If you received the Notice, you will not receive a print version of the proxy materials, unless you request one. If you would like to receive a print version of the proxy materials, free of charge, please follow the instructions on the Notice.

Cumulative voting allows a shareholder to multiply the number of shares owned by the number of directors to be elected and to cast the total for one nominee or distribute the votes among the nominees, as the shareholder desires. Shareholders may not cumulate their votes against a nominee. If shares are voted cumulatively and there are more nominees than there are director vacancies, nominees who receive the greatest number of votes will be elected. If you wish to cumulate your votes, you must sign and mail in your proxy card or attend the Annual Meeting.

All of Abbott's shareholders may vote by mail or at the Annual Meeting. Abbott's By-Laws provide that a shareholder may authorize no more than two persons as proxies to attend and vote at the meeting. Most of Abbott's shareholders may also vote their shares by telephone or the Internet. If you vote by telephone or the Internet, you do not need to return your proxy card. The instructions for voting can be found with your proxy card or on the Notice.

You may revoke your proxy by voting in person at the Annual Meeting or, at any time prior to the meeting:

DISCRETIONARY VOTING AUTHORITY

Unless authority is withheld in accordance with the instructions on the proxy, the persons named in the proxy will vote the shares covered by proxies they receive to elect the 1314 nominees named in Item 1 on the proxy card. Should a nominee become unavailable to serve, the shares will be voted for a substitute designated by the Board of Directors, or for fewer than 1314 nominees if, in the judgment of the proxy holders, such action is necessary or desirable. The persons named in the proxy may also decide to vote shares cumulatively in their sole discretion so that one or more of the nominees may receive fewer votes than the other nominees (or no votes at all), although they have no present intention of doing so. The proxy holders may not cast your vote for any nominee from whom you have withheld authority to vote.

Where a shareholder has specified a choice for or against the ratification of the appointment of Ernst & Young LLP as auditors, the advisory vote on the approval of executive compensation, or the approval of a shareholder proposal, or where the shareholder has abstained on these matters, the shares represented by the proxy will be

Abbott Laboratories 910 ![]()

voted (or not voted) as specified. Where no choice has been specified, the proxy will be voted FOR the ratification of Ernst & Young LLP as auditors, FOR the approval of executive compensation, and AGAINST the shareholder proposal.proposals.

With the exception ofAside from matters omitted fromset forth in this proxy statement, pursuant to the rules of the Securities and Exchange Commission, the Board of Directors is not aware of any other issue which may properly be brought before the meeting. If other matters are properly brought before the meeting, the accompanying proxy will be voted in accordance with the judgment of the proxy holders.

QUORUM AND VOTE REQUIRED TO APPROVE EACH ITEM ON THE PROXY

A majority of the outstanding shares entitled to vote on a matter, represented in person or by proxy, constitutes a quorum for consideration of that matter at the meeting. The affirmative vote of a majority of the shares represented at the meeting and entitled to vote on a matter shall be the act of the shareholders with respect to that matter.

EFFECT OF WITHHOLD VOTES, BROKER NON-VOTES, AND ABSTENTIONS

Shares represented by proxies which are present and entitled to vote on a matter but which have elected to withhold authority to vote for one or more directors or to abstain from voting on another matter will have the effect of votes against those directors or that matter. A proxy submitted by an institution, such as a broker or bank that holds shares for the account of a beneficial owner, may indicate that all or a portion of the shares represented by that proxy are not being voted with respect to a particular matter. This could occur, for example, when the broker or bank is not permitted to vote those shares in the absence of instructions from the beneficial owner of the shares. These "non-voted shares" will be considered shares not present and, therefore, not entitled to vote on those matters, although these shares may be considered present and entitled to vote for other purposes. Brokers and banks have discretionary authority to vote shares in the absence of instructions on matters the New York Stock Exchange considers "routine", such as the ratification of the appointment of the auditors. They do not have discretionary authority to vote shares in absence of instructions on "non-routine" matters. The election of directors, the advisory vote on the approval of executive compensation, and shareholder proposals are "non-routine" matters. Non-voted shares will not affect the determination of the outcome of the vote on any matter to be decided at the meeting.

The inspectors of election and the tabulators of all proxies, ballots, and voting tabulations that identify shareholders are independent and are not Abbott employees.

Abbott will bear the cost of making solicitations from its shareholders and will reimburse banks and brokerage firms for out-of-pocket expenses incurred in connection with this solicitation. Proxies may be solicited by mail, telephone, Internet, or in person by directors, officers, or employees of Abbott and its subsidiaries.

Abbott has retained GeorgesonMorrow Sodali LLC to aid in the solicitation of proxies at an estimated cost of $19,500 plus reimbursement for reasonable out-of-pocket expenses.

ABBOTT LABORATORIES STOCK RETIREMENT PLAN

Participants in the Abbott Laboratories Stock Retirement Plan will receive voting instructions for their shares held in the Abbott Laboratories Stock Retirement Trust. The Stock Retirement Trust is administered by both a trustee and an Investment Committee. The trustee of the Trust is The Northern Trust Company. The members of the Investment Committee are Stephen R. Fussell,Mary K. Moreland, Karen M. Peterson, and Brian P. Wentworth, employees of Abbott. The voting power with respect to the shares is held by and shared between the Investment Committee and the participants. The Investment Committee must solicit voting instructions from the participants and follow the voting instructions it receives. The Investment Committee may use its own discretion with respect to those shares for which no voting instructions are received.

10 Abbott Laboratories![]() 11

11

It is Abbott's policy that all proxies, ballots, and voting tabulations that reveal how a particular shareholder has voted be kept confidential and not be disclosed, except:

HOUSEHOLDING OF PROXY MATERIALS

Shareholders sharing an address may receive only one copy of the proxy materials or the Notice of Internet Availability of Proxy Materials, unless their broker, bank, or other intermediary has received contrary instructions from any shareholder at that address. This is known as "householding." Shareholders wishing to discontinue householding and receive separate copies of the proxy materials or the Notice of Internet Availability of Proxy Materials should notify their broker, bank, or other intermediary.

Abbott Laboratories 1112 ![]()

NOMINEES FOR ELECTION AS DIRECTORS

| | ROBERT J. ALPERN, M.D. Director since 2008 Age Ensign Professor of Medicine and Professor of Internal Medicine, and Former Dean of Yale School of Medicine, New Haven, Connecticut | |

Dr. Alpern has served as the Ensign Professor of Medicine and Professor of Internal Medicine and Dean ofat Yale School of Medicine since June 2004. From June 2004 to January 2020, Dr. Alpern served as Dean of Yale School of Medicine. From July 1998 to JuneMay 2004, Dr. Alpern was the Dean of The University of Texas Southwestern Medical Center. Dr. Alpern also serves as a Director of AbbVie Inc. and Tricida, Inc. and served as a Director on the Board of Yale New Haven Hospital.Hospital from October 2005 through January 2020.

As the Ensign Professora result of Medicine, Professor of Internal Medicine, and Dean ofhis long-tenured leadership positions at the Yale School of Medicine Dean ofand The University of Texas Southwestern Medical Center, and as a former Director on the Board of Yale New Haven Hospital, Dr. Alpern contributes valuable insights to the Board through his medical and scientific expertise and his knowledge of the health care environment and the scientific nature of Abbott's key research and development initiatives.

| | ROXANNE S. AUSTIN Director since 2000 Age President and Chief Executive Officer, Austin Investment Advisors, Newport Coast, California (Private Investment and Consulting Firm) | ||||

Ms. Austin is President and Chief Executive Officer of Austin Investment Advisors, a private investment and consulting firm, and chairs the U.S. Mid-Market Investment Advisory Committee of EQT Partners. Previously, Ms. Austin also served as the President and Chief Executive Officer of Move Networks, Inc., a provider of Internet television services. Ms. Austin served as President and Chief Operating Officer of DIRECTV, Inc. Ms. Austin also served as Executive Vice President and Chief Financial Officer of Hughes Electronics Corporation and as a partner of Deloitte & Touche LLP. Ms. Austin served on the Board of Directors of Telefonaktiebolaget LM Ericsson from 2008 to 2016. Ms. Austin currently serves on the Board of Directors of AbbVie Inc., CrowdStrike Holdings, Inc., Target Corporation, and Teledyne Technologies, Inc. Ms. Austin will not stand for re-election at Target Corporation's June 2020 annual meeting of shareholders.

Through her extensive management and operating roles, including her financial roles, Ms. Austin contributes significant oversight and leadership experience, including financial expertise and knowledge of financial statements, corporate finance and accounting matters.

12 Abbott Laboratories![]() 13

13

| | SALLY E. BLOUNT, PH.D. Director since 2011 Age Michael L. Nemmers Professor of Strategy and Former Dean of the J.L. Kellogg Graduate School of Management at Northwestern University, Evanston, Illinois | |

Ms. Blount is the Michael L. Nemmers Professor of Strategy and was theformer Dean of the J.L. Kellogg Graduate School of Management at Northwestern University from July 2010 to August 2018. From 2004 to 2010, she served as the Vice Dean and Dean of the Undergraduate College of New York University's Leonard N. Stern School of Business. Ms. Blount joined the faculty of New York University's Leonard N. Stern School of Business in 2001 and was the Abraham L. Gitlow Professor of Management and Organizations. Prior to joining NYU in 2001, Ms. Blount held academic posts at the University of Chicago's Graduate School of Business from 1992 to 2001. Ms. Blount currently serves on the Board of Directors of Ulta Beauty, Inc. and the Joyce Foundation.

AsHaving served as Dean of the J.L. Kellogg Graduate School of Management at Northwestern University and as the Vice Dean and Dean of the Undergraduate College of New York University's Leonard N. Stern School of Business, Ms. Blount provides Abbott's Board with expertise on business organization, governance and business management matters.

| | ROBERT B. FORD Director since 2019 Age 46 President and Chief Operating Officer, Abbott Laboratories | |

Mr. Ford has served as Abbott's President and Chief Operating Officer since 2018 and will succeed Mr. White as Abbott's Chief Executive Officer on March 31, 2020. Mr. Ford served as the Executive Vice President, Medical Devices from 2015 to 2018, Senior Vice President, Diabetes Care from 2014 to 2015, and Vice President, Diabetes Care, Commercial Operations from 2008 to 2014. Prior to 2008, he served in various leadership roles across Abbott's Diagnostics, Nutrition, and Diabetes Care businesses in the U.S. and Latin America. Mr. Ford joined Abbott in 1996.

Having held leadership positions across several of Abbott's businesses and ultimately assuming responsibility for all of Abbott's operating businesses as Chief Operating Officer, Mr. Ford contributes an extensive knowledge of the Company's global operations, a wide breadth of experience in strategy and execution, and valuable insights into global healthcare markets.

14 ![]()

| | MICHELLE A. KUMBIER Director since 2018 Age Senior Vice President and Chief Operating Officer of Harley-Davidson Motor Company, | ||||

Ms. Kumbier has served as Senior Vice President and Chief Operating Officer of Harley-Davidson Motor Company since October 2017. Previously, she served as its Senior Vice President, Motor Company Product and Operations from May 2015 to October 2017, as its Senior Vice President of Motorcycle Operations from September 2012 to April 2015, and as its Senior Vice President, Product Development from November 2010 to August 2012.

As the Senior Vice President and Chief Operating Officer of Harley-Davidson Motor Company, Ms. Kumbier contributes extensive experience in the management of a multinational public company, including significant manufacturing, product development, business development, and strategic planning experience.

Abbott Laboratories 13

| | EDWARD M. LIDDY Director since 2010 Age Retired Chairman & CEO, The Allstate Corporation, Northbrook, Illinois (Insurance Company) | |

Mr. Liddy served as a partner in the private equity investment firm Clayton, Dubilier & Rice, LLC from January 2010 to December 2015. At the request of the Secretary of the U.S. Department of Treasury, Mr. Liddy served as Interim Chairman and Chief Executive Officer of American International Group, Inc., a global insurance and financial services holding company, from September 2008 until August 2009. From January 1999 to April 2008, Mr. Liddy served as Chairman of the Board of the Allstate Corporation. He served as Chief Executive Officer of Allstate from January 1999 to December 2006, President from January 1995 to May 2005, and Chief Operating Officer from August 1994 to January 1999. Mr. Liddy currently serves on the Board of Directors of AbbVie Inc., 3M Company, and The Boeing Company. Mr. Liddy has reached the mandatory retirement age for directors at both Boeing and 3M and will not stand for re-election at either company's 2020 Annual Meeting.

Through his executive leadership at Allstate and American International Group, and his board service at several Fortune 100 companies across a broad range of industries, Mr. Liddy provides valuable insights on corporate strategy, risk management, corporate governance and many other issues facing large, global enterprises. Additionally, as a former chief financial officer, audit committee chair at Goldman Sachs and 3M Company, and partner at Clayton, Dubilier & Rice, LLC, Mr. Liddy provides significant knowledge and understanding of corporate finance, capital markets, financial reports and accounting matters.

![]() 15

15

| | DARREN W. MCDEW Director since 2019 Age 59 Retired General, United States Air Force, and Former Commander of U.S. Transportation Command, Scott Air Force Base, Illinois | ||

General McDew is a retired four-star general who served for 36 years in the United States military before retiring in October 2018. From August 2015 to August 2018, General McDew served as Commander, U.S. Transportation Command, the single manager for global air, land and sea transportation for the U.S. Department of Defense. Previously, he also served as Vice Director for Strategic Plans and Policy for the Joint Chiefs of Staff, Military Aide to the President, Director of Air Force Public Affairs, and Chief of Air Force Senate Liaison Division. General McDew currently serves on the Board of Directors of the Boys and Girls Club of America, United Services Automobile Association, and Rolls-Royce, North America, Inc.

Through his extensive leadership in the U.S. Air Force, General McDew contributes significant experience managing large, complex global operations, including strategic planning, security and risk management, cybersecurity, and supply chain and infrastructure management.

| | NANCY MCKINSTRY Director since 2011 Age Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V., Alphen aan den Rijn, the Netherlands | |

Ms. McKinstry has been the Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V. since September 2003 and a member of its Executive Board since June 2001. Ms. McKinstry also serves on the Board of Accenture plc, the Board of Overseers of Columbia Business School, and the Board of Directors of Russell Reynolds Associates. Ms. McKinstry is also a member of the European Round Table of Industrialists. Ms. McKinstry served on the Board of Directors of Telefonaktiebolaget LM Ericsson (LM Ericsson Telephone Company) from 2004 to 2012.

As the Chief Executive Officer and Chairman of the Executive Board of Wolters Kluwer N.V., Ms. McKinstry contributes global perspectives and management experience, including an understanding of key issues facing a multinational business such as Abbott's.

14 Abbott Laboratories16 ![]()

| | PHEBE N. NOVAKOVIC Director since 2010 Age Chairman and Chief Executive Officer, General Dynamics Corporation, Falls Church, Virginia (Worldwide Defense, Aerospace, and Other Technology Products Manufacturer) | |

Ms. Novakovic has been Chairman and Chief Executive Officer of General Dynamics Corporation since January 1, 2013. Previously, she served as President and Chief Operating Officer from May 2012 to December 2012 and as Executive Vice President, Marine Systems of General Dynamics from May 2010 to May 2012. From May 2005 to April 2010, Ms. Novakovic served as its Senior Vice President—Planning and Development. She was elected Vice President of General Dynamics in October 2002 after joining the company in May 2001. Previously, Ms. Novakovic was Special Assistant to the Secretary and Deputy Secretary of Defense, and had been a Deputy Associate Director of the Office of Management and Budget.

As a member of the Board of DirectorsChairman and Chief Executive Officer of General Dynamics Corporation, Ms. Novakovic has strong management experience with a major public company, including significant marketing, operational and manufacturing experience, and contributes valuable insights into finance and capital markets. Her tenure with the Office of Management and Budget and as Special Assistant to the Secretary and Deputy Secretary of Defense enables her to provide government perspective and experience in a highly regulated industry.

| | WILLIAM A. OSBORN Lead Independent Director Director since 2008 Age Retired Chairman and Chief Executive Officer of Northern Trust Corporation (Multibank Holding Company) and The Northern Trust Company, Chicago, Illinois (Banking Services Company) | ||||

Mr. Osborn was Chairman of Northern Trust Corporation from 1995 through 2009 and served as its Chief Executive Officer from 1995 through 2007. Mr. Osborn currently serves as a Director of Caterpillar Inc. and General Dynamics Corporation. Mr. Osborn served on the Board of Directors of Nicor, Inc. from 1999 to 2006 and on the Board of Directors of Tribune Company from 2001 to 2012.

As the Chairman and Chief Executive Officer of Northern Trust Corporation and The Northern Trust Company, Mr. Osborn acquired broad experience in successfully overseeing complex global businesses operating in highly regulated industries.

Abbott Laboratories 15![]() 17

17

|

Mr. Scott retired as Chairman, President and Chief Executive Officer of Corn Products International in 2009. He served as Chairman, President, and Chief Executive Officer from February 2001 until he retired in May of 2009. He was President and Chief Operating Officer from January 1998 until February 2001. He was President of the Corn Refining Division of CPC International from 1995 through 1997, when CPC International spun off Corn Products International as a separate corporation. Mr. Scott currently serves on the Board of Directors of Bank of New York Mellon Corporation and Motorola Solutions, Inc.

As the Chairman, President and Chief Executive Officer of Corn Products International, Mr. Scott acquired valuable business, leadership and management experience, including critical insights into matters relevant to a major public company and experience in finance and capital markets matters.

| | DANIEL J. STARKS Director since 2017 Age Retired Chairman, President and Chief Executive Officer of St. Jude Medical, Inc., St. Paul, Minnesota (Medical Device Manufacturer) | ||||

Mr. Starks served as the Chairman, President and Chief Executive Officer of St. Jude Medical, Inc., from 2004 until his retirement in January 2016, after which he served as its Executive Chairman of the Board until January 2017, when Abbott completed the acquisition of St. Jude Medical, Inc.Medical. Mr. Starks also served as President and Chief Operating Officer of St. Jude Medical Inc. from 2001 to 2004 and as its President and CEO, Cardiac Rhythm Management Business from 1997 to 2001.

Having served as St. Jude Medical's Executive Chairman and its Chairman, President and Chief Executive Officer, and having joined St. Jude Medical in 1996, Mr. Starks contributes not only comprehensive and critical knowledge of St. Jude Medical's operations, but also extensive business and management experience operating a global public company in a highly regulated industry.

16 Abbott Laboratories

| | JOHN G. STRATTON Director since 2017 Age Retired Executive Vice President and President of Global Operations, Verizon Communications Inc., New York, New York | |

Mr. Stratton served as Executive Vice President and President of Global Operations of Verizon Communications Inc. from February 2015 to December 2018. Previously, he served as Executive Vice President and President of Global Enterprise and Consumer Wireline from April 2014 to February 2015, as President of Verizon Enterprise Solutions from January 2012 to April 2014, and as Chief Operating Officer and Executive Vice President of Verizon Wireless from October 2010 to January 2012. Since October 2012, Mr. Stratton hascurrently serves on the Board of Directors of General Dynamics Corporation. Mr. Stratton also served as a member of The President's National Security Telecommunications Advisory Committee. Mr. Stratton also servedCommittee from October 2012 to July 2018 and as Director of the Cellular Telecommunications Industry Association from February 2015 to July 2018.

Through his executive leadership at Verizon Communications, Mr. Stratton contributes extensive business and management experience operating a global public company such as Abbott, including valuable insights on corporate strategy and risk management. His service on the National Security Telecommunications Advisory Committee enables him to provide government perspective and experience in a highly regulated industry.

18 ![]()

| | GLENN F. TILTON Director since 2007 Age Retired Chairman, President and Chief Executive Officer of UAL Corporation, Chicago, Illinois (Airline Holding Company) | |

Mr. Tilton served as Chairman, President and Chief Executive Officer of UAL Corporation, and Chairman and Chief Executive Officer of United Air Lines, Inc., an air transportation company and wholly owned subsidiary of UAL Corporation, from September 2002 to October 2010. Mr. Tilton also served on the Board of United Continental Holdings, Inc. from 2001 to 2013 and served as its Non-Executive Chairman of the Board from October 2010 to December 2012. Mr. Tilton is also a Director of AbbVie Inc. and Phillips 66. Mr. Tilton also served on the Board of Directors of Lincoln National Corporation from 2002 to 2007, of TXU Corporation from 2005 to 2007, of Corning Incorporated from 2010 to 2012, and as Chairman of the Midwest for JPMorgan Chase & Co. and a member of its companywide Executive Committee from June 2011 to June 2014.

Having previously served as Chief Executive Officer of UAL Corporation and United Air Lines, Non Executive Chairman of the Board of United Continental Holdings, Inc., Chairman of the Midwest for JPMorgan Chase & Co., Chairman, President, and Vice Chairman of Chevron Texaco, and as Interim Chairman of Dynegy, Inc., Mr. Tilton acquired strong management experience overseeing complex multinational businesses operating in highly regulated industries, as well as expertise in finance and capital markets matters.

Abbott Laboratories 17

| | MILES D. WHITE Director since 1998 Age Chairman of the Board and Chief Executive Officer, Abbott Laboratories | |

Mr. White has served as Abbott's Chairman of the Board and Chief Executive Officer since 1999. He served as an Executive Vice President of Abbott from 1998 to 1999. He joined Abbott in 1984. He currently serves as a Director of Caterpillar Inc. and McDonald's Corporation.

Serving as Abbott's Chairman of the Board and Chief Executive Officer since 1999 and having joined Abbott in 1984, Mr. White contributes not only his valuable business, management and leadership experience, but also his extensive knowledge of the Company and its global operations, as well as key insights into strategic, management and operation matters, ensuring the appropriate level of oversight and responsibility is applied to all Board decisions.

18 Abbott Laboratories![]() 19

19

THE BOARD OF DIRECTORS AND ITS COMMITTEES

THE BOARD OF DIRECTORS |

The Board of Directors held 67 meetings in 2018.2019. The average attendance of all directors at Board and committee meetings in 20182019 was 98 percent95% and each director attended at least 75% of the total number of Board meetings and meetings of the committees on which he or she served. Abbott encourages its Board members to attend the annual shareholders meeting. Last year, all of Abbott's directors attended the annual shareholders meeting.

The Board has determined that each of the following directors is independent in accordance with the New York Stock Exchange listing standards: R. J. Alpern, R. S. Austin, S. E. Blount, M. A. Kumbier, E. M. Liddy, D. W. McDew, N. McKinstry, P. N. Novakovic, W. A. Osborn, S. C. Scott III, D. J. Starks, J. G. Stratton, and G. F. Tilton. To determine independence, the Board applied the categorical standards attached as Exhibit A to this proxy statement. The Board also considered whether a director has any other material relationships with Abbott or its subsidiaries and concluded that none of these directors had a relationship that impaired the director's independence. This included consideration of the fact that some of the directors or their family members are officers or serve on boards of companies or entities to which Abbott sold products or made contributions or from which Abbott purchased products and services during the year. In making its determination, the Board relied on both information provided by the directors and information developed internally by Abbott.

The Board has risk oversight responsibility for Abbott and administers this responsibility both directly and with assistance from its committees.

LEADERSHIP STRUCTURE |

The BoardMiles D. White has determined that the current leadership structure, in which the offices ofserved as Abbott's Chairman and Chief Executive Officer are held by one individualsince 1999. In November 2019, Abbott announced that Mr. White will step down as Chief Executive Officer on March 31, 2020 and an independent director actsremain Executive Chairman. The Board also unanimously appointed Robert B. Ford, the current President and Chief Operating Officer and a 24-year Abbott veteran, to succeed Mr. White as lead independent director, ensuresChief Executive Officer and named him to the appropriate levelBoard, effective November 12, 2019.

The Board is actively involved in succession planning and is focused on ensuring leadership continuity. The Board believes that the continuation of oversight, independence, and responsibility is applied to all Board decisions, including risk oversight, andMr. White's service as Executive Chairman is in the best interests of Abbott and its shareholders.

Chairman/Chief Executive Officer

The Board we benefit from his strategic and operational insights, enablingalso has a focused vision encompassing the full range, from long-term strategic direction to day-to-day execution

The Board reviews its leadership structure on at least an annual basis. The Board has determined that this leadership structure ensures the appropriate level of oversight, independence and responsibility is applied to all Board decisions, including risk oversight, and is in the best interests of Abbott and its shareholders.

Abbott Laboratories 1920 ![]()

DIRECTOR SELECTION |

The Nominations and Governance Committee assists the Board of Directors in identifying individuals qualified to become Board members and recommends to the Board the nominees for election as directors at the next annual meeting of shareholders. The process used by the Nominations and Governance Committee to identify a nominee to serve as a member of the Board of Directors depends on the qualities being sought. From time to time, Abbott engages an executive search firm to assist the Committee in identifying individuals qualified to be Board members.

Abbott's outline of directorship qualifications, which is part of Abbott's corporate governance guidelines, is available in the corporate governance section of Abbott's investor relations website (www.abbottinvestor.com). These qualifications describe specific characteristics that the Nominations and Governance Committee and the Board take into consideration when selecting nominees for the Board, such as: strong management experience and senior levelsenior-level experience in medicine, hospital administration, medical and scientific research and development, finance, international business, technology, government, and academic administration. An individual nominee is not required to satisfy all the characteristics listed in the outline of directorship qualifications and there is no requirement that all such characteristics be represented on the Board.

In addition, Board members should have backgrounds that, when combined, provide a portfolio of experience and knowledge that will serve Abbott's governance and strategic needs. Board candidates will be considered on the basis of a range of criteria, including broad-based business knowledge and relationships, prominence, and excellent reputations in their primary fields of endeavor, as well as a global business perspective and commitment to good corporate citizenship. Directors should have demonstrated experience and ability that is relevant to the Board of Directors' oversight role with respect to Abbott's business and affairs. Each director's biography includes the particular experience and qualifications that led the Board to conclude that the director should serve on the Board. The directors' biographies are on pages 1213 through 18.19.

A description of the procedure for the recommendation and nomination of directors, including by proxy access, is on page 73.82.

![]() 21

21

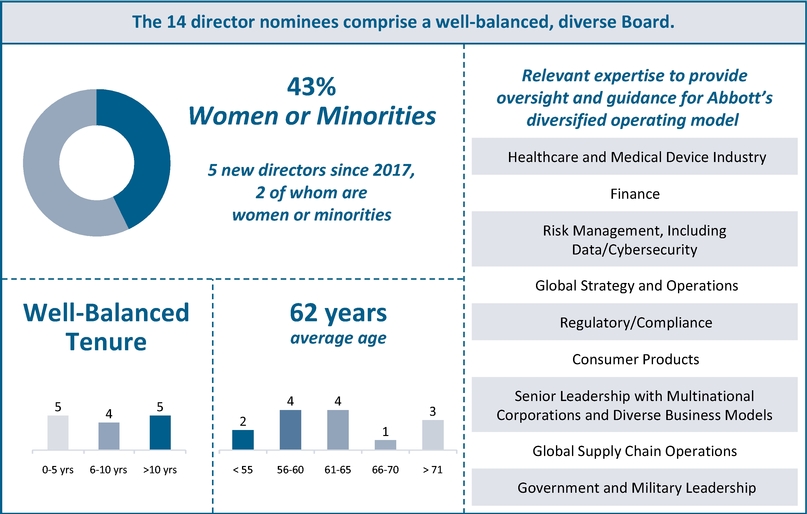

BOARD DIVERSITY AND COMPOSITION |

In the process of identifying nominees to serve as a membermembers of the Board of Directors, the Nominations and Governance Committee considers the Board's diversity of relevant experience, areas of expertise, ethnicity, gender, and geography and assesses the effectiveness of the process in achieving that diversity. Six of the 13 directors nominated for election are women or minorities.

The process used to identify and select nominees has resulted in an experienced,a balanced, diverse, and well-rounded Board of Directors that possesses the skills, experiences, and perspectives necessary for its oversight role. All of Abbott's directors exhibit:

| Global business perspective | ✓

| Successful track record | ✓ | Innovative thinking | |||||

✓ | Knowledge of corporate governance requirements and practices |

| High integrity |

| Commitment to good corporate citizenship |

20 Abbott Laboratories22 ![]()

The following table details some of the attributes, skills, and experience represented on Abbott's Board of Directors:

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

|

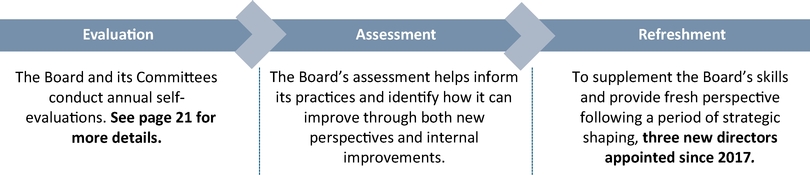

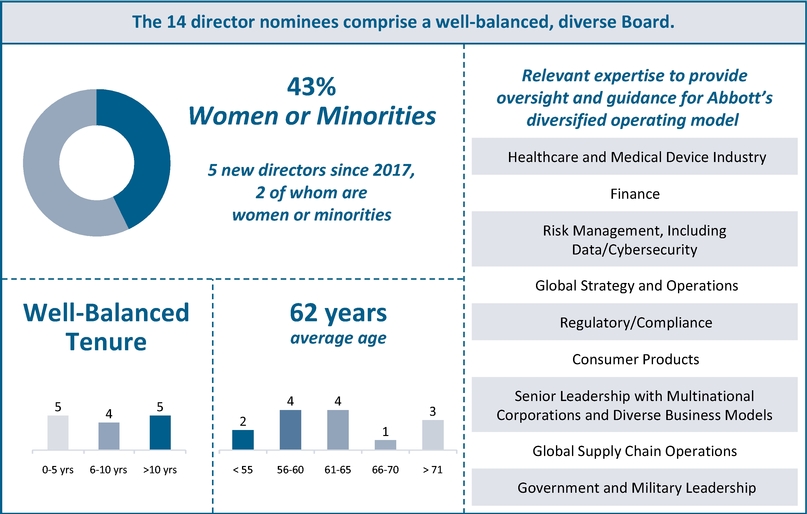

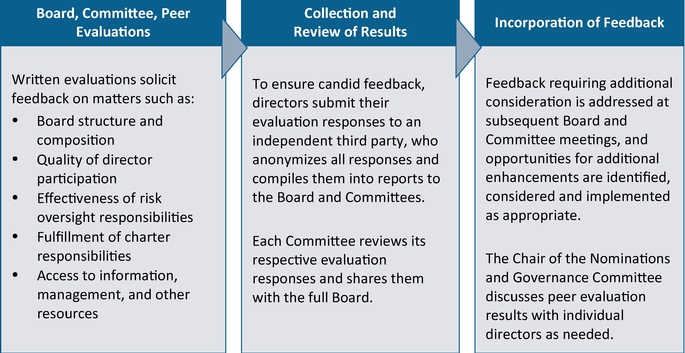

BOARD EVALUATION PROCESS |

Each year, Abbott's directors evaluate the effectiveness of the Board and its Committees in performing its governance and risk oversight responsibilities. Directors assess the performance of their peers, as well as the full Board of Directors and each of the Committees on which they serve, and their peers, as follows:

Abbott Laboratories 21![]() 23

23

COMMITTEES OF THE BOARD OF DIRECTORS |

The Board of Directors has five committees established in Abbott's By-Laws: Audit Committee, Compensation Committee, Nominations and Governance Committee, Public Policy Committee, and Executive Committee. Each of the

All members of the Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee isare independent. These Committees are governed by written charters setting forth their respective responsibilities, and each Committee reviews its charter at least annually, with any changes being recommended to the full Board for approval. Copies of the Committee charters are all available in the governance section of Abbott's investor relations website (www.abbottinvestor.com).

| | Current Members | Audit* | Compensation | Nominations and Governance | Public Policy | Executive | | | Current Members | Audit* | Compensation | Nominations and Governance | Public Policy | Executive | | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | R. J. Alpern | | | | | | | | R. J. Alpern | | | | | | | |||||||||||||

| | R. S. Austin | | | | | | | | | | | R. S. Austin | | | | | | | | | | |||||||

| | S. E. Blount | | | | | | | | S. E. Blount | | | | | | | |||||||||||||

| | | M. A. Kumbier | | | | | | | | | | | | | R. B. Ford | | | | | | | | | | | | ||

| | E. M. Liddy | | | | | | | | M. A. Kumbier | | | | | | | |||||||||||||

| | | N. McKinstry | | | | | | | | | | | | E. M. Liddy | | | | | | | | | | |||||

| | P. N. Novakovic | | | | | | | | D. W. McDew | | | | | | | |||||||||||||

| | | W. A. Osborn | | | | | | | | | | | N. McKinstry | | | | | | | | | | | |||||

| | S. C. Scott III | | | | | | | | P. N. Novakovic | | | | | | | |||||||||||||

| | | D. J. Starks | | | | | | | | | | | | | W. A. Osborn | | | | | | | | | |||||

| | J. G. Stratton | | | | | | | | S. C. Scott III | | | | | | | |||||||||||||

| | | G. F. Tilton | | | | | | | | | | | | D. J. Starks | | | | | | | | | | | | |||

| | M. D. White | | | | | | | | J. G. Stratton | | | | | | | |||||||||||||

| | | Total Meetings Held in 2018 | | 7 | | 4 | | 5 | | 4 | | 0 | | | | G. F. Tilton | | | | | | | | | | | ||

| | M. D. White | | | | | | | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | Total Meetings Held in 2019 | | 7 | | 4 | | 4 | | 4 | | 0 | | |

| | | | | | | | | | | | | | | | ||||||||||||||

![]()

![]()

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibility with respect to to:

24 ![]()

In performing these functions, the Audit Committee is governed by a written charter. meets regularly with the independent auditor, Abbott's management, and Abbott's internal auditors to review the adequacy, effectiveness and quality of Abbott's accounting and financial reporting principles, policies, procedures and controls, as well as Abbott's enterprise risk management, including Abbott's risk assessment and risk management policies.

A copy of the report of the Audit Committee is on page 65.69.

The Compensation Committee assists the Board of Directors in carrying out the Board's responsibilities relating to the compensation of Abbott's executive officers and directors. The Committee is governed by a written charter. The Compensation CommitteeIts primary responsibilities include:

22 Abbott Laboratories

compensation, the Compensation Committee takes comparable director fees into account and reviews any arrangement that could be viewed as indirect director compensation.

This Committee also reviews, approves,

The Compensation Committee has the sole authority, under its charter, to select, retain, and/or terminate independent compensation advisors. The Committee engaged Meridian Compensation Partners, LLC as its compensation consultant for 2018. Meridian performs no other work for Abbott. The Committee engages

The Committee determines what variables it will instruct the consultant to consider, and they include:including peer groups against which performance and pay should be examined, financial metrics to be used to assess Abbott's relative performance, competitive long-term incentive practices in the marketplace, and compensation levels relative to market practice. The Committee negotiates and approves any fees paid to the consultant for these services.

The Compensation Committee engaged Meridian Compensation Partners, LLC as its compensation consultant for 2019. Meridian performs no other work for Abbott. Based on its evaluation of Meridian's independence in accordance with the New York Stock Exchange listing standards and information provided by Meridian, the Committee determined that the work performed by Meridian does not present any conflicts of interest.

A copy of the Compensation Committee report is on page 46.50.

Nominations and Governance Committee

The Nominations and Governance Committee assists the Board of Directorsin fulfilling its oversight responsibility with respect to governance matters. Its primary responsibilities include:

The process used by this Committee to identify a nominee to serve as a member of the Board of Directors depends on the qualities being sought. From time to time, Abbott engages an executive search firm to assist the Committee in identifying individuals qualified to be Board members. The process used by the Committee to identify nominees is described on page 2021 in the section captioned, "Director Selection."

![]() 25

25

The Public Policy Committee assists the Board of Directors in fulfilling its oversight responsibility with respect to Abbott's public policy, certainto:

The Executive Committee may exercise all the authority of the Board in the management of Abbott, except for matters expressly reserved by law for Board action.

Abbott Laboratories 23

COMMUNICATING WITH THE BOARD OF DIRECTORS |

Interested parties may communicate with the Board of Directors by writing a letter to the Chairman of the Board, to the ChairmanChair of the Nominations and Governance Committee, who acts as the lead independent director, at the meetings of the independent directors, or to the independent directors c/o Abbott Laboratories, 100 Abbott Park Road, D-364, AP6D, Abbott Park, Illinois 60064-6400,60064, Attention: Corporate Secretary. The General Counsel and Corporate Secretary regularly forwards to the addressee all letters other than mass mailings, advertisements, and other materials not relevant to Abbott's business. In addition, directors regularly receive a log of all correspondence received by the CompanyAbbott that is addressed to a member of the Board and may request any correspondence on that log.

CORPORATE GOVERNANCE MATERIALS |

Abbott's corporate governance guidelines, outline of directorship qualifications, director independence standards, code of business conduct, and the charters of Abbott's Audit Committee, Compensation Committee, Nominations and Governance Committee, and Public Policy Committee are all available in the corporate governance section of Abbott's investor relations website (www.abbottinvestor.com).

26 ![]()

|

Our CEO isMessrs. White and Ford are not compensated for serving on the Board or Board committees. Abbott's remaining directors, who are all non-employee directors, are compensated for their service under the Abbott Laboratories Non-Employee Directors' Fee Plan and the Abbott Laboratories 2017 Incentive Stock Program.

The following table sets forth a summary of the non-employee directors' 20182019 compensation.

| | Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(4) | All Other Compensation ($)(5) | Total ($) | | | Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(4) | All Other Compensation ($)(5) | Total ($) | | |||||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||||||||||||

| | R. J. Alpern | | | $ | 126,000 | | | $ | 174,977 | | | $ | 0 | | | $ | 35,499 | | | $ | 25,000 | (5) | | $ | 361,476 | | | R. J. Alpern | | | $ | 126,000 | | | $ | 174,910 | | | $ | 0 | | | $ | 64,323 | | | $ | 25,000 | | | $ | 390,233 | | |||

| | R. S. Austin | | | 152,000 | | | 174,977 | | | 0 | | | 0 | | | 0 | | | 326,977 | | | | R. S. Austin | | | 152,000 | | | 174,910 | | | 0 | | | 0 | | | 0 | | | 326,910 | | | |||||||||||||

| | S. E. Blount | | | 126,000 | | | 174,977 | | | 0 | | | 6,168 | | | 25,000 | (5) | | 332,145 | | | S. E. Blount | | | 126,000 | | | 174,910 | | | 0 | | | 10,355 | | | 25,000 | | | 336,265 | | |||||||||||||||

| | M. A. Kumbier | | | 64,500 | | | 0 | | | 0 | | | 0 | | | 0 | | | 64,500 | | | | M. A. Kumbier | | | 132,000 | | | 174,910 | | | 0 | | | 0 | | | 0 | | | 306,910 | | | ||||||||||||

| | E. M. Liddy | | | 151,000 | | | 174,977 | | | 0 | | | 0 | | | 0 | | | 325,977 | | | E. M. Liddy | | | 151,000 | | | 174,910 | | | 0 | | | 0 | | | 0 | | | 325,910 | | |||||||||||||||

| | N. McKinstry | | | 132,000 | | | 174,977 | | | 0 | | | 0 | | | 10,000 | (5) | | 316,977 | | | | D. W. McDew | | | 31,500 | | | 0 | | | 0 | | | 0 | | | 0 | | | 31,500 | | | ||||||||||||

| | P. N. Novakovic | | | 141,000 | | | 174,977 | | | 0 | | | 0 | | | 0 | | | 315,977 | | | N. McKinstry | | | 132,000 | | | 174,910 | | | 0 | | | 0 | | | 0 | | | 306,910 | | |||||||||||||||

| | W. A. Osborn | | | 156,000 | | | 174,977 | | | 0 | | | 0 | | | 0 | | | 330,977 | | | | P. N. Novakovic | | | 141,000 | | | 174,910 | | | 0 | | | 0 | | | 0 | | | 315,910 | | | ||||||||||||

| | S. C. Scott III | | | 132,000 | | | 174,977 | | | 0 | | | 0 | | | 25,000 | (5) | | 331,977 | | | W. A. Osborn | | | 156,000 | | | 174,910 | | | 0 | | | 0 | | | 0 | | | 330,910 | | |||||||||||||||

| | D. J. Starks | | | 126,000 | | | 174,977 | | | 0 | | | 0 | | | 0 | | | 300,977 | | | | S. C. Scott III | | | 132,000 | | | 174,910 | | | 0 | | | 0 | | | 25,000 | | | 331,910 | | | ||||||||||||

| | J. G. Stratton | | | 126,000 | | | 174,977 | | | 0 | | | 0 | | | 0 | | | 300,977 | | | D. J. Starks | | | 126,000 | | | 174,910 | | | 0 | | | 0 | | | 0 | | | 300,910 | | |||||||||||||||

| | G. F. Tilton | | | 132,000 | | | 174,977 | | | 0 | | | 0 | | | 25,000 | (5) | | 331,977 | | | | J. G. Stratton | | | 126,000 | | | 174,910 | | | 0 | | | 0 | | | 0 | | | 300,910 | | | ||||||||||||

| | G. F. Tilton | | | 132,000 | | | 174,910 | | | 0 | | | 0 | | | 25,000 | | | 331,910 | | ||||||||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||||||||||||

24 Abbott Laboratories

or paid currently into an individual grantor trust established by the director. The distribution of deferred fees and amounts held in a director's grantor trust generally commences when the director reaches age 65, or upon retirement from the Board of Directors, if later. The director may elect to have deferred fees and fees deposited in trust credited to either a guaranteed interest account or to a stock equivalent account that earns the same return as if the fees were invested in Abbott stock.shares. If necessary, Abbott contributes funds to a director's trust so that as of year-end the stock equivalent account balance (net of taxes) is not less than seventy-five percent of the market value of the related common stockshares at year-end.

![]() 27

27

share of common stock for each restricted stock unit outstanding under the Incentive Stock Program. Each director is required to own, within five years of becoming a director, the number of shares of Abbott stock having a fair market value equal to four times the annual director fees earned or paid in cash. All directors with 5five years tenure meet or exceed the guidelines. The following Abbott restricted stock units were outstanding as of December 31, 2018:2019: R. J. Alpern, 28,165;30,406; R. S. Austin, 35,828;38,069; S. E. Blount, 21,425;23,666; M. A. Kumbier, 2,241; E. M. Liddy, 23,592;25,833; N. McKinstry, 21,425;23,666; P. N. Novakovic, 23,592;25,833; W. A. Osborn, 30,082;32,323; S. C. Scott III, 31,812;34,053; D. J. Starks, 6,382;8,623; J. G. Stratton, 2,945;5,186; and G. F. Tilton, 31,812.

34,053.

Abbott Laboratories 2528 ![]()

SECURITY OWNERSHIP OF EXECUTIVE OFFICERS AND DIRECTORS

The table below reflects the number of Abbott common shares beneficially owned as of January 31, 20192020 by each director, the Chief Executive Officer, the Chief Financial Officer, and the three other most highly paid executive officers in 2019 (the "named officers"), and by all directors and executive officers of Abbott as a group. It also reflects the number of stock equivalent units held by non-employee directors under the Abbott Laboratories Non-Employee Directors' Fee Plan and restricted stock units held by non-employee directors, named officers, and executive officers.

| Name | Shares Beneficially Owned(1)(2) | Stock Options Exercisable Within 60 Days of January 31, 2019(3) | Stock Equivalent Units | Name | Shares Beneficially Owned(1)(2) | Stock Options Exercisable Within 60 Days of January 31, 2020(3) | Stock Equivalent Units | |||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

| H. L. Allen | 134,114 | 909,294 | 0 | R. J. Alpern | 30,406 | 0 | 7,766 | |||||||||||||

| | R. J. Alpern | 28,165 | 0 | 7,270 | | R. S. Austin | 44,913 | 47,883 | 0 | | ||||||||||

| R. S. Austin | 42,672 | 36,200 | 0 | S. E. Blount | 26,266 | 0 | 0 | |||||||||||||

| | S. E. Blount | 26,525 | 0 | 0 | | L. D. Earnhardt | 56,946 | 0 | 0 | |||||||||||

| R. B. Ford | 166,267 | 713,059 | 0 | R. B. Ford | 197,382 | 926,022 | 0 | |||||||||||||

| | S. R. Fussell | 162,773 | 477,685 | 0 | | M. A. Kumbier | 3,258 | 0 | 0 | | ||||||||||

| M. A. Kumbier | 1,004 | 0 | 0 | E. M. Liddy | 28,153 | 46,743 | 21,268 | |||||||||||||

| | E. M. Liddy | 25,912 | 35,137 | 20,932 | | D. W. McDew | 0 | 0 | 0 | | ||||||||||

| N. McKinstry | 21,425 | 37,756 | 0 | N. McKinstry | 23,666 | 47,902 | 0 | |||||||||||||

| | P. N. Novakovic | 24,092 | 92,106 | 0 | | P. N. Novakovic | 26,333 | 102,943 | 0 | | ||||||||||

| W. A. Osborn | 54,082 | 37,200 | 28,061 | W. A. Osborn | 56,323 | 49,190 | 28,512 | |||||||||||||

| | S. C. Scott III | 37,812 | 31,476 | 7,025 | | D. G. Salvadori | 95,088 | 461,015 | 0 | |||||||||||

| D. J. Starks | 7,016,442 | 0 | 0 | S. C. Scott III | 40,053 | 41,622 | 7,138 | |||||||||||||

| | J. G. Stratton | 6,400 | 0 | 3,085 | | D. J. Starks | 7,018,683 | 0 | 0 | | ||||||||||

| G. F. Tilton | 39,162 | 0 | 32,193 | J. G. Stratton | 8,641 | 0 | 4,651 | |||||||||||||

| | M. D. White | 3,160,054 | 5,390,671 | 0 | | G. F. Tilton | 41,403 | 0 | 32,710 | | ||||||||||

| B. B. Yoor | 99,679 | 553,613 | 0 | M. D. White | 3,194,710 | 5,417,294 | 0 | |||||||||||||

| | All directors and executive officers as a group(4)(5) | 12,274,355 | 12,983,686 | 98,566 | | B. B. Yoor | 116,620 | 184,281 | 0 | | ||||||||||

| All directors and executive officers as a group(4)(5) | 12,502,322 | 12,334,341 | 102,045 | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

None of the directors, named officers, or executive officers has pledged shares.

26 Abbott Laboratories![]() 29

29

COMPENSATION DISCUSSION AND ANALYSIS |

This Compensation Discussion and Analysis (CD&A) describes Abbott's executive compensation program in 2018.2019. In particular, this CD&A explains how the Compensation Committee (the Committee) and Board of Directors made compensation decisions for the Company's executives, including the five named officers: Miles D. White, Chairman of the Board and Chief Executive Officer; Robert B. Ford, President and Chief Operating Officer; Brian B. Yoor, Executive Vice President, Finance and Chief Financial Officer; Hubert L. Allen,Lisa Earnhardt, Executive Vice President, General CounselMedical Devices; and Secretary; Robert B. Ford, President and Chief Operating Officer; and Stephen R. Fussell,Daniel G. Salvadori, Executive Vice President, Human Resources.Nutritional Products.

The CD&A also describes the process the Committee utilizes to examine performance in the context of executive pay decisions, the performance goals and results for each named officer, and recent updates to our compensation program. This year's CD&A reflects the feedback from our shareholders gathered during our extensive 20182019 shareholder outreach described on page 28.31.

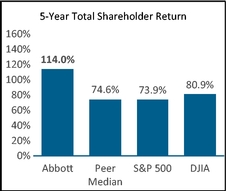

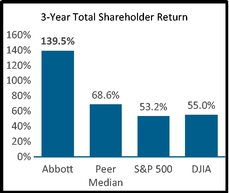

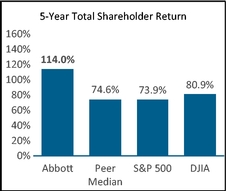

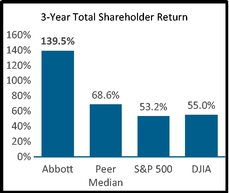

InAbbott's three-year total shareholder return (TSR) of 139.5% is more than twice that of the peer group median and the broader Standard & Poor's 500 (S&P 500) and Dow Jones Industrial Average (DJIA) market indices. These consistent above-market returns are driven by the strength of our leadership positions in some of the largest and fastest growing markets in healthcare and innovative product portfolios across our businesses.